When the coronavirus pandemic hit the U.S. in March, the Brierley Institute for Customer Engagement’s executive-in-residence Hal Brierley and director Marci Armstrong began to notice companies intensifying their communications with customers.

The Cox School’s Brierley Institute for Customer Engagement — the first academic institute of its kind and created in 2016 through a gift from veteran marketing executive Brierley and his wife — teaches MBA students to examine and explore why customers engage with brands, and how that engagement drives loyalty and value. The pandemic offers a unique opportunity to gauge how consumers’ behavior and intention change as companies evolve as well.

“If we are to help business students design customer engagement programs,” says Brierley, also CEO of The Brierley Group and noted loyalty program pioneer, “it behooves us to understand how this black swan event — the pandemic — changes behavior. The Brierley Institute is committed to understanding what’s happening each day as we go through this pandemic.”

In the earliest days of the pandemic, Brierley and Armstrong, a longtime professor and marketing researcher, observed that some companies were not truly acknowledging how the landscape was changing dramatically, but instead focused mainly on sales messages. “We began to wonder what the typical person was thinking,” Armstrong says. She and Brierley decided that a series of national surveys covering a cross-section of demographic groups throughout the pandemic would help them understand how it was changing consumer behavior and intentions.

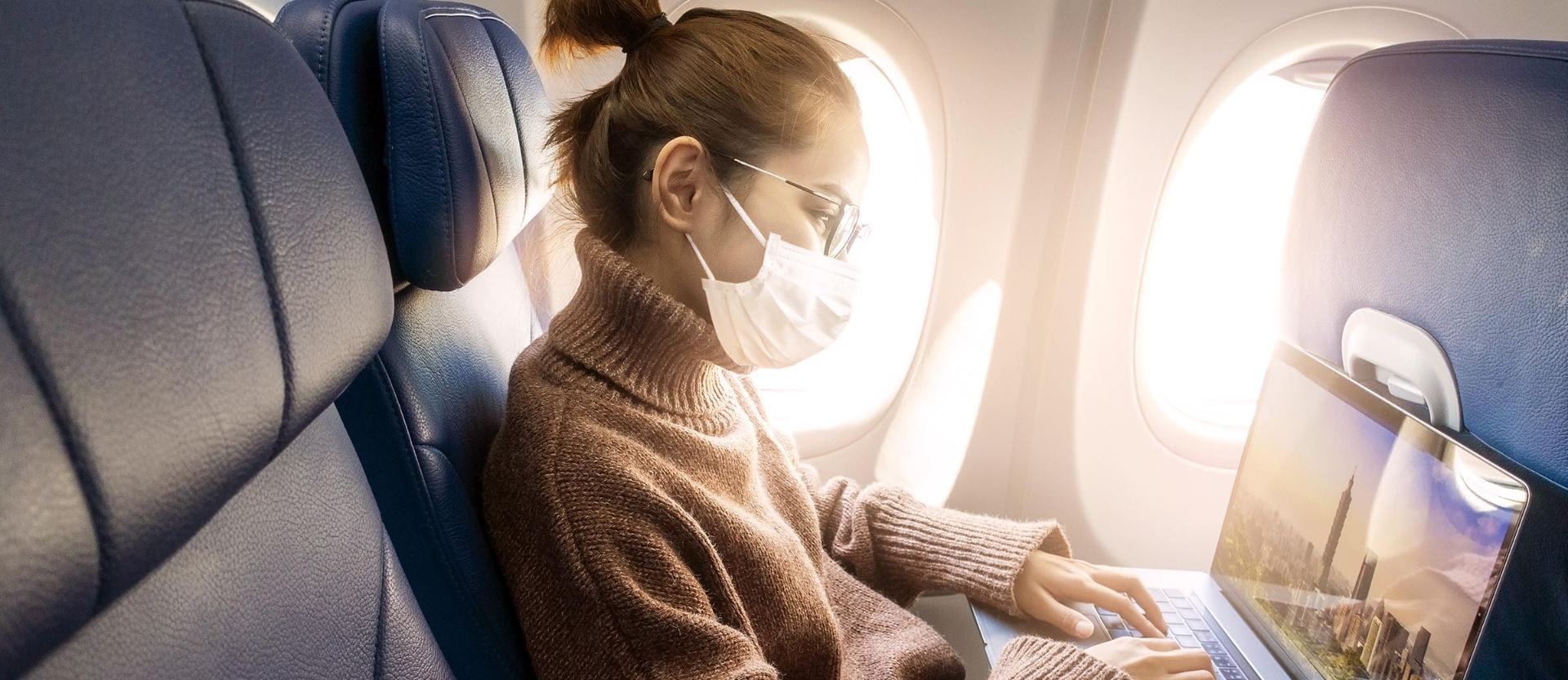

Early in the summer, the Brierley Institute, in conjunction with first-party consumer data and insights platform Dynata, began surveying consumers’ behavior, sentiments about what companies are doing, future purchase intentions and participation in rewards programs. The research first focused on retailers and the travel industry, two sectors particularly impacted by the pandemic due to restrictions on movement and shopping. In late summer, the Institute sent out surveys to create a baseline about the entertainment industry (predominantly movie theaters) and sporting events, as both began reopening.

Each round of surveys asks consumers how COVID-19 is impacting their finances, their buying habits, and when they anticipate getting back to normal. Surveys have been repeated every six to eight weeks in order to track changes over time. Armstrong explains that by doing so, “We see that the rate of changes may be more revealing than respondents’ replies to individual surveys. Learning over time and revising our surveys helps us to gain deeper understanding. As we learn from each survey’s results, we revise questions for the following survey based on what we learned.” As an example, Brierley points to the results of the first survey on travel: “We started to wonder why people were starting to travel again. Was it because they HAD to travel (need) or because they had a desire to travel. Understanding that difference could have major implications for how travel industry businesses can stimulate more travel.”

Despite less traveling during the pandemic and considerable migration to online shopping, the research suggests that customer engagement programs and incentives can help recapture lost sales. It also indicates that companies should continue communicating with their customers, who intend to spend and travel in the coming months.

The Brierley Institute, say Brierley and Armstrong, teaches future marketers about empathy and that it requires listening and asking consumers what they really want. “Listen, then tailor what you do to what they tell you,” they say. “Our biggest challenge is to spread the word from what we’re learning beyond the classroom to reach today’s marketers.” With that in mind, here are six key takeaways from the Brierley Institute’s COVID-19 impact surveys.

1. Communication Helped Buoy Demand for Retailers

Two retail surveys conducted in early June and mid-July, six weeks apart, examined how shopping behavior had changed and how loyalty program members responded to communications. Were shoppers ready to resume spending?

In the first retail study, 52% of heavy spenders (participants spending $250 or more per month and those most aggressively targeted by retailers) said they received more messages during the pandemic from their favorite retailers; 40% said the messages were increased their likelihood to buy.

And for 40%, messages acknowledging COVID-19 increased their plans to buy. Specifically, “people [were] responding to messages about sanitizing facilities, planes and stores, and were more responsive in July than June about wearing masks and social distancing,” says Armstrong.

However, she says companies do not need to be scared of a selling message; heavy spenders and loyalists (loyalty- or rewards-program members) are still responding well to these. “Heavy spenders want to spend, but they were more nervous than general shoppers about finances,” Brierley says. “This group is also more anxious to spend and get life back to normal in positive ways.”

2. As the Pandemic Continued, Spending Trended Down

As the pandemic has continued, survey respondents have become increasingly cautious.

“Most surprising of late is that the heavy spenders believe it’s going to take longer to get back to normal,” Brierley says. Initially, most respondents — 42% — believed things would be better in six months’ time, but by the second survey, 70% thought it would be at least a year before things go back to normal.

“[The number of] those wishing to travel, attend movies and shop in stores dropped significantly” between surveys, according to Brierley. The second retail survey also showed that shoppers spent less in July than in June, perhaps due to a decrease in optimism. However, he believes if there is favorable news about rapid tests or vaccines, optimism could improve again.

Despite the drop-in spending, loyalty programs continue to entice heavy spenders and loyalists. “Any retailer that thinks consumers don’t want to be bothered at this time is making a mistake,” Brierley says.

3. Shopping Moved Online

There’s room for optimism, but companies need to be proactive. The first retail study found that shoppers moved more than half of their purchases online during COVID-19 and planned to keep nearly half of their purchases online after stores reopened.

The second retail study revealed more than half of the purchases that were moved online went to the website of their preferred physical store retailer. Armstrong suggests that companies use an omnichannel strategy to get customers back in-store. “If you have expensive brick-and-mortar stores, there are incentives you can offer and different [digital] strategies to get consumers to stores, but it will require effort.”

4. Frequent Travelers Stayed Engaged with Loyalty Programs

Brierley was an early pioneer in rewards and customer loyalty programs and was instrumental in the wide-reaching success of the American Airlines AAdvantage rewards program. The travel study found that COVID-19 has not reduced frequent travelers’ interest in rewards or loyalty programs. In fact, 50% of respondents expected to be more active.

“Even with those who travel less often, we can start to influence how some of the major loyalty programs better respond to consumers as they move through the stages of the pandemic,” Brierley says. “Because of rewards programs,” he says, “retailers have the ability to reach out, talk to consumers, ask what they can do. If they reach out and communicate, they’ll learn that some messages resonate better than others. Successful rewards programs understand this and motivate consumers to do what they really want to do whether it is to return to traveling or get back into shopping in-store.”

The research clearly showed that different groups of customers were motivated differently. There were those driven by having middle seats blocked, those who most want bonus miles, those who wanted low fares and those who wanted to fast-track to VIP status. Understanding this, travel companies can better tailor their rewards and benefits to fit consumer motivations.

5. Travelers Want to Start Traveling Again

Brierley and Armstrong say their research dispels some myths companies believe about their customers during this pandemic. For example, some airlines have underestimated how much people would want to travel during this time. The surveys show that interest in travel is strong, in spite of the pandemic’s dampening effects. 40% of travelers say their past travel has primarily been because of a desire to travel, with only 5% of travelers saying travel was primarily due to a need to travel (perhaps business related), with 55% saying past travel was a balance between desire and need.

One-third of those who have taken cruises in the past three years say they plan to cruise again within the next six months, and two-thirds say they’ll cruise within the next year. Sixty-four percent say they will be traveling more, not less, in the future, with 28% saying they’ll be traveling a lot more.

“What’s also misunderstood is how strong the appetite is to return to spending once things are more open,” Brierley says. Travelers intended to participate in more loyalty programs in the future, too.

6. Travelers Are Not Changing Their Credit Card Habits

While travel has been dramatically reduced during the pandemic, travelers have continued to use travel credit cards that earn airline miles or hotel points during the pandemic, suggesting they plan to continue to travel and use these points in the future. Forty percent of those who actively use a travel credit card have charged 80% or more of the amount this year as they did last year. Thirty-two percent of those who actively use two or more travel credit cards are using the cards a lot more this year than in 2019.

How Companies Should Adapt

Living through this pandemic is helping companies better understand their loyal and non-loyal customers, and the survey results provide opportunities to hone messaging. “The pandemic will allow us to prove that having a direct relationship with your customer is very important when a crisis occurs,” Brierley says.