In this note, we provide context to understand Silicon Valley Bank’s failure. We start by explaining the rationale for the inherent fragility of banks. This understanding is important as it provides a basis to examine and evaluate key decisions made by Silicon Valley Bank (SVB) that ultimately brought about its demise. We then examine SVB’s financials to highlight the significant risks it had accumulated. It is important to note that unlike bank failures leading up to the financial crisis of 2008, SVB’s failure was not due to the credit risk of its loans and investments. Rather, accumulating large uninsured deposits and significant duration risk brought about its downfall. We conclude by providing commentary on some of the remedies or regulatory responses that have been discussed, such as increased capital requirements, increased regulation and potentially insuring all deposits.

Background

On Friday, March 10, federal regulators seized the assets of SVB in what is the second-largest bank failure in the U.S. after the collapse of Washington Mutual in 2008. The regulatory action was necessitated by one of the largest and quickest runs on a bank witnessed in the U.S. SVB started experiencing deposit withdrawals in 2022. Its deposits declined by about $16 billion in 2022. This decline was potentially due to the economic shock to the tech industry, which comprised a large fraction of their deposit base, and perhaps the depositors had started to worry about accumulating (yet unrecognized) losses in SVB’s investment portfolio.

On Wednesday, March 8, SVB announced a combined common and preferred stock offering to shore up its capital, given that it had sold approximately $21 billion of investments at an after-tax loss of $1.8 billion to meet the withdrawal demand. This offering signaled SVB’s precarious liquidity and caused many depositors (a large fraction of whom were uninsured) to withdraw nearly $42 billion in deposits on Thursday, March 9, further worsening SVB’s liquidity. This prompted the intervention from regulators on Friday, March 10. SVB’s failure triggered unprecedented withdrawals at Signature Bank in New York. The regulators, worried about the potential contagion effect of these bank failures, guaranteed all uninsured deposits at these banks to calm the markets.

Banks Are Fragile

A bank’s business model involves raising the bulk of its capital from depositors and a smaller amount from equity holders and using these funds to make loans to businesses and individuals. Most deposits are demandable (i.e., short-term liabilities for banks), while the loans it makes are long-term, with terms of up to 30 years for mortgage loans. This results in a mismatch between a bank’s liabilities and its assets. This maturity mismatch is inherent to a bank’s business model and highlights banks’ key role in our capital markets; banks transform illiquid loans into liquid liabilities. A key point to highlight is that a bank’s capital structure is inherently risky due to this maturity mismatch. Even if the bank is solvent, it will typically not have enough liquidity to meet withdrawal demands if enough depositors wish to withdraw their deposits all at once. This then begs the question of why banks are financed with short-term loans (deposits) while their assets are long-term (loans).

Economic theory provides a framework for understanding a bank’s capital structure. A bank’s business model is a black box whereby a bank can significantly change the risk profile of its loan portfolio in a relatively short period of time. This action is difficult for outsiders (depositors and shareholders) to monitor and control. These information and control problems make it difficult for banks to raise long-term debt as a bank can significantly increase the risk of the loan portfolio after obtaining the financing to the detriment of the lenders. Equity financing is also costly for banks for the same reason—the ability to change the risk profile of the loans, ex-post. On the other hand, the benefit of financing a bank with uninsured demand deposits is that if the bank is perceived as taking excessive risks or misallocating funds, depositors can “run” or “vote with their feet” by withdrawing their deposits immediately. Thus, the threat of a credible “run” serves as a disciplinary mechanism for banks by forcing them to manage their risks prudently (see Diamond and Dybvig, 1983 and Calomiris and Kahn, 1991 for a formal development of this theory).

The above discussion highlights the importance of prudent risk management for banks, particularly the importance of being sensitive to maturity mismatch and liquidity risks inherent in a bank’s business model.

SVB’s Business Model and Early Warning Signs

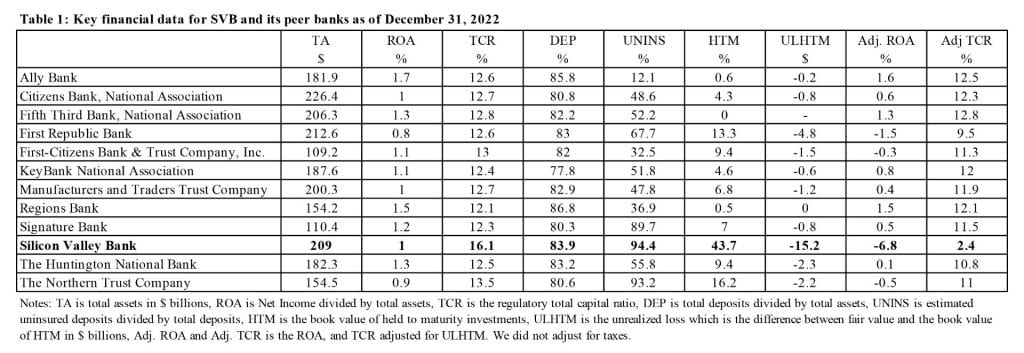

Let’s now examine SVB’s actions using the above framework and compare them to its peer group (publicly listed commercial bank or its bank holding company with total assets between $100 billion and $250 billion as of December 31, 2022). See Table 1 for some key statistics of SVB and its peers.

At first glance, SVB is not an outlier in this group based on ROA (Net income as a % of total assets) or DEP (deposits as a percentage of total assets). However, a closer examination reveals that SVB’s uninsured deposits-to-total deposits ratio was 94%, the highest among its peers. While our focus for this article is on SVB, Signature Bank, which is in the peer group, had a similarly high ratio of uninsured deposits (90%). SVB, like several other banks, experienced a flood of deposits over the last couple of years, and its deposits grew from about $63 billion in the fourth quarter of 2019 to $200 billion in the first quarter of 2022. A significant portion of the deposit growth (estimated to be $125 billion) was uninsured deposits. This kind of explosive growth in deposits, especially uninsured deposits, is risky for a bank as this funding source is not stable, unlike retail deposits. Since uninsured depositors are not protected, they will be very sensitive to the bank’s solvency risk and are more likely to withdraw their deposits at the hint of trouble. This would then precipitate a liquidity crisis for the bank. SVB’s management and its Board (as well as the regulators) would have been aware of this risk.

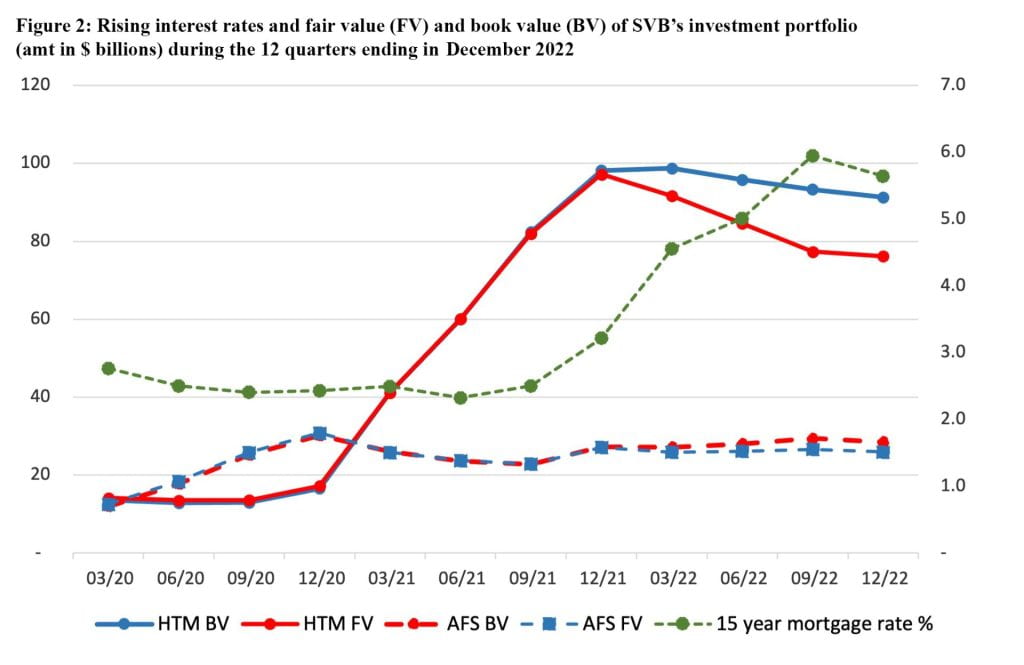

SVB further compounded its risk by investing the cash received from these deposits in investment securities, particularly in mortgage-backed securities with maturities exceeding ten years (see Figure 1). These long-duration securities offer a higher yield than short-term securities, but the long-duration securities are also more sensitive to interest rate changes and hence would decline in value if the interest rates were to go up. Banks typically classify their investments in these securities by designating them as either Available-for-Sale (AFS) or Hold-to-Maturity (HTM). The accounting treatment of AFS and HTM differ in terms of how changes in market value are recognized on the financial statements.

The accounting rules require that AFS be carried at fair value on the balance sheet, with periodic unrealized gains and losses recognized in Equity through inclusion in the Accumulated Other Comprehensive Income (AOCI) but do not affect the Income Statement till they are sold. In contrast, if the bank can show that it has the intent and the ability to hold the debt security till maturity, then it can classify these securities as HTM (this treatment is available to all firms, not just banks). The HTM securities are carried at amortized cost on the balance sheet, meaning that the periodic unrealized gains and losses resulting from changes in their fair value are not recognized in Net Income nor AOCI since the bank intends to hold these securities till maturity.1 Thus, in most circumstances, any unrealized gains and losses on AFS and HTM securities would not affect regulatory ratios.2

To be fair, it is not unusual for banks to invest their cash in treasuries or other highly rated securities such as Mortgage-backed Securities (MBS) issued by the Government Sponsored Entities (GSEs), as these securities are safe and liquid and offer a modest return. However, it is unusual for banks to hold almost half of their assets in investments, especially in the HTM portfolio. SVB’s ratio of HTM securities to Total Assets was 44% at the end of 2022 (see Table 1) and was by far the highest among its peers. Furthermore, out of the $91 billion investment in HTM securities, $86 billion was invested in MBS securities with a maturity of greater than ten years (reported clearly in its 10-K). In other words, SVB took on a huge duration risk. Not surprisingly, when the Federal Reserve increased interest rates (resulting in a corresponding increase in mortgage rates), the value of these securities went down significantly, as shown in Figure 2 below.

The fair value of both the HTM and the AFS portfolio declined. However, given that AFS securities are reported at fair value, there is little divergence between the dashed red and blue lines in Figure 2. On the other hand, the solid red line diverges dramatically from the solid blue line showing the decline in the value of the HTM portfolio, which was not recognized in the books. However, a bank is still required to disclose the fair value of HTM securities so that a reader of the financial statements can easily know the amount of unrecognized gain or loss. In fact, SVB’s balance sheet for the fiscal year 2022 clearly shows that the HTM securities were carried at $91.3 billion while their fair value was $76.2 billion. Thus, the unrecognized loss relating to HTM securities was $15.1 billion as of the end of 2022. This unrealized loss was disclosed every quarter as it accumulated over the four quarters in 2022. The unrecognized losses were $7 billion, $11 billion and $15.9 billion at the end of the first, second and third quarters of 2022, respectively.

If the losses from the decline in fair value of HTM securities were to be recognized in Net Income, they would have wiped out virtually all of SVB’s Net Income and Regulatory Capital. In contrast, the impact of unrealized losses on SVB’s peer banks was far less severe (see column ULHTM in Table 1). Note that the Fed’s sharp increase in interest rates would have affected all the banks, but the peer banks did not take on the kind of duration risk that SVB took on; hence, their losses were less severe than SVB’s.

One can tell the story of SVB’s failure as a perfect storm that was brewing with risk stemming from investment in long-duration securities, which resulted in considerable losses in an environment of rising interest rates, the accounting and regulatory treatment of HTM securities that allowed SVB to shield its Net Income, Equity, and Regulatory Capital from these losses and the extremely high level of uninsured depositors who panicked once the issue of unrealized losses came to the forefront in a Twitter fueled world. However, the key driver of SVB’s failure was its poor risk management.

SVB’s failure also raises questions about SVB’s governance and oversight. Why did the Board not attempt to rein in these risks, particularly as they developed over time? Why didn’t the regulators force early action before the unrealized losses became massive? Why didn’t the equity analysts raise any concerns? One can also question whether the auditors could have said something about the build-up of risks at SVB. While the auditors’ job is not to advise the management on risk management, it is their job to highlight the significant risks their client faces. However, if the auditors had raised concerns about the bank’s stability, it would have run the risk of becoming a self-fulfilling prophecy.

What Next?

In response to SVB’s failure and subsequent bailout, there has been much talk of potential remedies. Some have argued for stronger regulation and increased capital requirements. Some have argued that perhaps all deposits should be insured as businesses do not have the time or ability to monitor their bank’s actions. We offer some thoughts on these remedies below.

First, the above analysis suggests that SVB’s failure was due to poor risk management. In fact, SVB was an outlier in taking on excessive risks on several key dimensions: (i) a high proportion of uninsured deposits, (ii) lack of diversity in its depositor base and (iii) excessive duration risk in its investment portfolio. If so, then does it make sense to impose an additional regulatory burden and increased capital requirements on other prudently managed banks? This is important as several smaller banks have complained about the cost of regulatory burden. In fact, new bank charters have been at an all-time low in the last decade.

Further increasing the regulatory burden may make it difficult for smaller regional banks to compete successfully against the larger banks. This may result in more consolidation in the sector, with smaller banks being acquired by the larger banks. This will reduce competition and affect access to capital for smaller businesses. Many small businesses bank with regional banks as there is an ongoing relationship with the bank, and the banker has a lot of soft information about the borrower, which is not easily discerned from hard data. Academic work suggests that bigger banks are less likely to rely on soft information in their loan-granting decisions, while smaller banks take soft information into account in their decisions (Peterson and Rajan, 1994, Berger and Udell, 2002). Thus, increased consolidation may result in less reliance on relationship banking, hurting smaller businesses.

Second, each time a bank is bailed out, it blunts market discipline. The blunting of market discipline (by guaranteeing all deposits, for example) will likely increase moral hazard in the future. In other words, guaranteeing all deposits may incentivize banks to take on even more risks and disincentivize large depositors from monitoring their banks. The advantage of market discipline is that market discipline is typically targeted toward poorly performing or poorly managed banks. The market does not discipline banks that are well-run and allocate capital efficiently. In contrast, excess regulation can potentially impose a cost on all banks and may be less efficient. For example, the short interest as of January 31, 2023, in SVB and Signature Bank was 6.1% and 5.1%, respectively, relative to the average of 2.6% for the rest of the peer group suggesting that short sellers did not indiscriminately target all banks but specifically targeted banks like SVB with poor risk management.

Finally, is it appropriate to afford an HTM treatment (carrying an investment at amortized cost) to securities with maturities exceeding ten years? Given banks’ inherently fragile capital structure and the volatile interest rate environment, can any bank financed primarily by short-term deposits claim that it could hold even a 10-year bond to maturity? Furthermore, while the losses on HTM securities were visible, they did not impact SVB’s capital. If, instead, these unrealized losses had impacted SVB’s capital, could it have created greater urgency for an intervention by the Board or the regulators? Could it have forced SVB to raise capital before it was too late?

Regulators and standard setters face a difficult task and have a lot of constituents to please. If it seems that a bank failure may result in widespread contagion, even if such a likelihood is low, the regulators may step in as no one wants to risk presiding over another financial crisis. Viewed with this lens, the regulatory action to protect all deposits at SVB may seem reasonable. However, by highlighting the above trade-offs, we hope that the regulators and standard setters take time to evaluate the costs and benefits of the various regulatory responses and not respond with a knee-jerk reaction to the failure of SVB.

1The recently implemented current expected credit losses (CECL) standard changes the accounting for securities. In particular, it states that financial instruments carried at amortized cost reflect net amount expected to be collected.

2A bank may choose AOCI filter option and include unrealized gains and losses in the computation of regulatory capital.

References:

Berger, Allen N., and Gregory F. Udell. 2002. “Small Business Credit Availability and Relationship Lending: The Importance of Bank Organisational Structure.” The Economic Journal 112 (477): F32–53. https://doi.org/10.1111/1468-0297.00682.

Calomiris, Charles W., and Charles M. Kahn. “The Role of Demandable Debt in Structuring Optimal Banking Arrangements.” The American Economic Review 81, no. 3 (1991): 497–513. http://www.jstor.org/stable/2006515.

Diamond, Douglas W., and Philip H. Dybvig. 1983. “Bank Runs, Deposit Insurance, and Liquidity.” Journal of Political Economy 91 (3): 401–19. https://doi.org/10.1086/261155.

Petersen, Mitchell A. and Raghuram G. Rajan.” The Benefits of Lending Relationships: Evidence from Small Business Data”. The Journal of Finance 49, 1 (1994): 3-37.